Find plans starting from ₹20/day*

Self

Wife

Mother

Father

Find Always Enough Health Insurance Plan

A health insurance premium calculator lets you quickly see personalized premium estimates based on your age, coverage, city, and policy type. Ideal for comparing options, budgeting smartly, and making confident choices. Find the right health insurance premium quickly with this easy premium calculator, designed to fit your needs.

WHY BUY FROM APOLLO

Unlock Apollo Exclusive Benefits

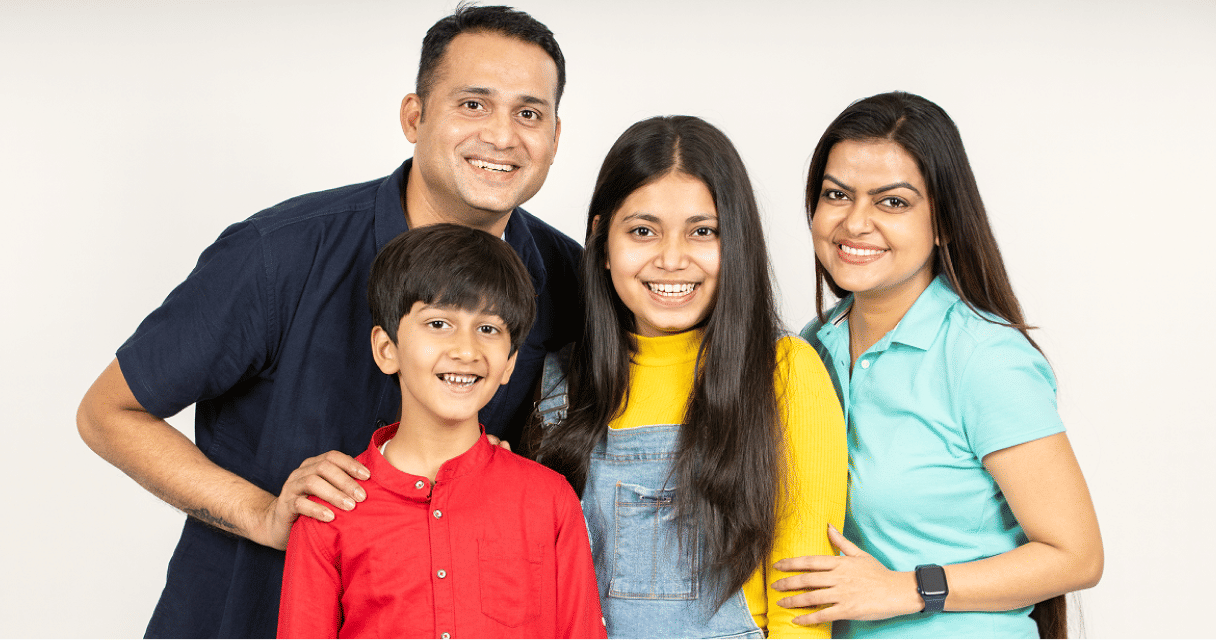

Why Do You Need Health Insurance in India?

Health insurance helps you manage the high cost of medical treatment in India. Whether it’s an illness, accident, or emergency, health insurance protects your savings and gives you the peace of mind you require.

With the right plan, you get cashless hospitalisation, tax benefits under Section 80D, and coverage for doctor visits, tests, and even post-treatment care. Buying a policy early means lower premiums and shorter waiting periods, so you're covered when it matters most.

Key Reasons to Buy a Health Insurance Plan

Health insurance helps you manage the high cost of medical treatment in India. Whether it’s an illness, accident, or emergency, health insurance protects your savings and gives you the peace of mind you require.

With the right plan, you get cashless hospitalisation, tax benefits under Section 80D, and coverage for doctor visits, tests, and even post-treatment care. Buying a policy early means lower premiums and shorter waiting periods, so you're covered when it matters most.

Rise in lifestyle and chronic diseases in India

Diseases like diabetes, high blood pressure, heart issues, and cancer are on the rise in India and often require long-term care. Health insurance helps manage the high cost of ongoing treatments, medications, and hospital visits.

Rising medical costs in India

Medical treatment is getting more expensive every year, medical inflation in India reached 13% in 2024. A single hospitalisation can cost lakhs, especially for advanced care. Health insurance helps protect your savings and reduces your out-of-pocket expenses.

Access to cashless treatment at network hospitals

Most insurers today offer cashless hospitalisation across a wide hospital network. This means you don’t have to pay anything upfront during emergencies, just focus on getting better while your insurer settles the bill directly.

Tax benefits under Section 80D

Health insurance also helps you save on taxes. Under Section 80D, you can claim deductions of up to ₹25,000 for self and family, and an additional ₹50,000 for insuring senior citizen parents, totalling up to ₹1,00,000 a year

How to Find an Always Enough Health Insurance Plan?

Choose a plan that fits your age, health needs, family size, and budget prioritise cashless hospitalisation, OPD, shorter waiting periods, and NCB. If you’re unsure, Apollo 24|7 insurance advisors can compare options and help you pick dependable, high-value cover.

Here's What to Check While Buying a Health Insurance Plan

Go for the right sum insured

Pick a sum insured that protects your savings: ₹10–15L for individuals, ₹20–25L+ for families. Go higher if you live in Tier-1 cities, have seniors/PEDs, or lack employer cover

Check Waiting Periods & Moratorium

Prefer plans with waiting periods under 24–36 months. After 8 years of continuous cover (IRDAI moratorium), claims aren’t contestable except for fraud

Check Room Rent Limits to Avoid Extra Costs

If your policy caps room rent and you choose a pricier room, your whole claim can be reduced proportionately. Pick no cap or a cap that matches private room rates in your city to avoid out-of-pocket surprises

Look for a High Claim Settlement Ratio

Claim Settlement Ratio is the percentage of insurance claims an insurer has paid out compared to the total claims they received in a year. For example, if the CSR is 97%, the insurance provider has paid 97 out of every 100 claims

Confirm OPD, Day-care & Modern treatments

Choose a plan that covers OPD consults, day-care surgeries, and modern treatments (e.g., robotic surgery). This keeps out-of-pocket costs low and lets you get timely care without hospital admission

Expert's Advice

Look beyond the benefits and premium always check the claim settlement ratio, network hospital list, and hidden limits like room rent capping or co-pay clauses.

Benefits of Health Insurance

Think of health insurance like a helmet for your finances that protects you when things go wrong. It gives you a peace of mind with the benefits like cashless treatment, tax savings, and if you buy early, it’s like paying a low EMI for a secure future.

Read on to understand the extensive benefits of health insurance

Cashless Hospitalization and Wide Network Coverage

You can get treated at network hospitals without paying upfront — the insurance provider settles the bill directly. Most insurers have a wide network of 5,000+ hospitals.

Comprehensive Pre and Post Hospitalization Coverage

It’s not just about basic hospitalisation coverage. Your health Insurance will cover costs like doctor visits, tests, and medicines before and after hospitalisation (usually up to 30–90 days)

Coverage for Critical Illnesses and Specialized Treatments

Critical Illness Plans can cover serious conditions like cancer, heart disease, kidney failure, and more the medical cost could burn a hole in your pocket.

Domiciliary Hospitalisation

Domiciliary hospitalisation means getting treatment at home instead of a hospital (as advised by doctor), when you can’t be moved due to your condition or no hospital bed is available.

Ambulance Charges

These days most health plans offer compensation of ambulance charges depending upon plan to plan and coverage amount.

Inclusion of Alternative and Preventive Treatments

Many plans cover AYUSH treatments (Ayurveda, Yoga, Unani, Siddha and Homeopathy) and offer free annual check-ups for preventive measures

Commonly Opted Mediclaim Plans

by Budget

₹5 Lakh

starts at ₹150/month

₹10 Lakh

starts at ₹150/month

₹15 Lakh

starts at ₹150/month

₹20 Lakh

starts at ₹150/month

What are the Documents Required for Health Insurance?

You’ll need to submit a few basic documents to verify your identity, health status, and eligibility while buying a health insurance plan. Documents Required for Health Insurance:

Identity Proof

Aadhaar Card, PAN Card, Voter ID, Passport, or Driving License

Address Proof

Aadhaar Card, Utility Bill, Passport, or Rent Agreement

Passport-size Photograph

For higher age groups or people with pre-existing conditions, the insurer may ask for basic health check-ups

Age Proof

Birth Certificate, PAN Card, School Leaving Certificate, Passport, etc.

Income Proof

Salary slips, ITR, or bank statements (in some cases)

Medical Reports

For higher age groups or people with pre-existing conditions, the insurer may ask for basic health check-ups

Know the Different Types of Health Insurance Plans

Not all health insurance plans are the same. Here’s a quick guide to help you choose the one that caters to your needs.

How to choose adequate health insurance coverage?

The right health insurance coverage protects you when it matters, without making you pay more than you need to. In 2025, a single hospitalisation can cost ₹3–₹10 lakh depending on the illness, city, and type of hospital. Here's how you can choose coverage that's always enough for your real needs.

Assess your healthcare needs and family medical history

Assess your health, age, and family size first. If you or family have chronic conditions, choose a higher sum insured with fewer restrictions and cover all dependents needed.

Evaluate medical inflation and cost of treatment in your city

Care in Tier-1 cities often costs ~2X smaller towns (e.g., knee replacement ₹3.5–₹5.5L vs ₹2–₹2.5L). Choose cover based on where you’ll get treated add a buffer for medical inflation.

Plan for life stage changes and future health risks

Needs change by life stage newly married: maternity/newborn; mid-life: lifestyle conditions; seniors: comprehensive with OPD & pre/post-hospitalisation. Choose a plan that allows upgrades/add-ons so your cover grows with you

Consider the role of top-ups and super top-ups

Top-ups boost cover for a lower premium after your base/deductible is used, they pay the big bills. Eg: ₹5L base + ₹10L top-up with ₹5L deductible - expenses beyond ₹5L are covered; ideal for major or repeat hospitalisations

What Are Riders and Add-Ons?

Riders & Add-ons are optional extras you attach to your health plan to plug gaps such as maternity, critical illness and more. You pay a little extra amount, typically cheaper than a separate policy; pricing depends on your age, sum insured, and the rider chosen. Example: if your base plan doesn’t cover cancer costs, a critical illness rider pays a lump sum on diagnosis to fund treatment or replace income.

Key Health Insurance Riders & Add-ons Explained

Here are some of the most useful riders to consider:

Diseases and Health Insurance Coverage

All IRDAI-regulated insurers follow clear norms for coverage, waiting periods, and exclusions Content for covered

- Infectious diseases such as dengue, malaria, typhoid, COVID-19, influenza, and other viral infections

- Critical illnesses such as cancer, kidney failure, stroke, major organ transplants (if covered or via rider)

- Accidental injuries & surgeries - Emergency treatments, fractures, and hospitalisation after accidents

- Day-care procedures: Cataract, tonsillectomy, hernia repair, chemotherapy, and dialysis

Expert Guided Health Insurance Plans by Lifestages

Your health insurance needs change as your life changes. Whether you’re starting your career, growing your family, or planning for retirement, choosing the right plan at the right time can save money and offer better protection. Our experts help you select coverage that’s tailored to your current life stage.

Life Stage | Recommended | Suggested | Typical Premium Range* | Key |

|---|---|---|---|---|

Young Professionals (20s-30s) | High coverage at low cost, no room rent cap, wellness rewards, annual health check-ups, OPD cover optional, minimal waiting periods | ₹10-15 lakh | ₹5,000- ₹12,000 annually | Affordable premiums, early tax savings (Sec 80D), long-term premium lock-in, early PED coverage |

Newly Married & Young Families | Family floater plan, maternity & newborn cover, vaccination & child wellness benefits, no-claim bonus, restoration benefit | ₹15-20 lakh | ₹12,000- ₹25,000 annually | One plan for entire family, maternity support, cost-effective child coverage, bonus for claim-free years |

Parents & Mid-Career (40s-50s) | Higher sum insured, critical illness rider, comprehensive lifestyle disease coverage, low co-pay, no disease-specific sub-limits | ₹20-25 lakh | ₹20,000- ₹40,000 annually | Covers major illnesses, protects savings, faster claim settlement, broader treatment choices |

Senior Citizen & Retirees | Pre-existing disease coverage, minimal waiting period, high network hospital count, domiciliary care, AYUSH treatments | ₹15-20 lakh | ₹40,000- | Immediate coverage for chronic conditions, easy cashless access, alternative treatment options |

How is Health Insurance Premium Calculated?

Your health insurance premium is calculated based on how much risk the insurer takes to cover you. The more the risk, the higher your premium. Here's a breakdown of the key factors that impact your health insurance premium:

Expert's Advice

Always ask your insurer for a detailed list of inclusions and exclusions, and check the waiting periods and sub-limits (e.g., cap on room rent or specific surgeries) before making a decision.

Health Insurance Checklist

Get covered confidently. Check these essentials to compare smartly and buy quickly

Choose the right plan type

Decide between Individual vs Family‑Floater policies. Family‑floaters are cost‑efficient for families, while individual plans suit older or high‑risk members

Validate Sum Insured (Coverage Amount)

Ensure it covers real costs. Experts suggest minimum ₹3 lakhs for individuals and ₹5 lakhs ordinarily. Families or those in metros may need ₹10–15 lakhs to stay future‑proof

Review Coverage Scope

Check that your policy includes pre‑/post‑hospitalization, day‑care, AYUSH/alternative treatments, and preventive check‑ups. Avoid co‑payments if possible

Inspect Waiting Periods & Exclusions

Prefer plans with shorter waiting for pre‑existing conditions. Study exclusions like cosmetic surgeries or substance treatment to avoid surprises later.

Check Room Rent Limits & Sub-Limits

Look for plans with no room‑rent capping. Capping can drastically reduce your claim. Also, avoid disease‑specific sub‑limits. Look for unlimited restoration benefits.

Confirm Network Hospitals & Cashless Coverage

A wide hospital network ensures easier access to cashless treatments—critical during emergencies.

Reputation, Claim Settlement & NCB

Choose insurers with high claim settlement ratios, fast service, and No‑Claim Bonus (NCB) benefits. Read reviews to gauge performance.

Wish you had chosen better? You still can!

Port your policy

Port your health insurance seamlessly, retain existing benefits, avoid new waiting periods, and enjoy better service and savings.

All without any break in coverage

What’s Covered in a Health Insurance Policy (Inclusions)

Hospitalisation expenses

due to illness, injury, or accident, including room rent, ICU charges, surgeries, nursing, etc.

Pre-hospitalisation costs

like doctor consultations, blood tests, X-rays, and scans, typically up to 30 days before hospital admission.

Post-hospitalisation expenses

such as follow-up visits, medicines, and diagnostic tests, generally covered for 60–90 days after discharge.

Daycare procedures

that don’t require 24-hour hospitalisation, e.g. cataract surgery, dialysis, tonsillectomy, chemotherapy, etc.

Ambulance charges

most plans cover up to ₹1,000–₹2,000 per hospitalisation

AYUSH treatments

(Ayurveda, Yoga, Unani, Siddha, Homoeopathy), if your plan includes AYUSH cover.

Tip for Policy Buyers

Always ask your insurer for a detailed list of inclusions and exclusions, and check the waiting periods and sub-limits (e.g., cap on room rent or specific surgeries) before making a decision.

Health Insurance IRDAI Guidelines (2024-2025)

Over the years, health insurance plans have become easily accessible and with extensive benefits. Read on to know the eligibility criteria according IRDAI guidelines-

FAQs

What is health insurance?

Why do I need health insurance?

How does health insurance work?

Can I cover my family under one policy?

Quick Links

- Find Always Enough Health Insurance Plan

- Why Do You Need Health Insurance in India?

- Key Reasons to Buy a Health Insurance Plan

- How to Find an Always Enough Health Insurance Plan?

- Here's What to Check While Buying a Health Insurance Plan

Get Expert Help, Receive a Callback